There is almost never another purchase that is more useful than insurance when it comes to general insurance. Essentially, it is the answer to the ‘what if’ question. The question that every bike owner has is, “What if my bike is in an accident?” It is conceivable. Even if you buy two-wheeler insurance online, figuring out how to use it can be difficult. This could be due to how your insurance provider processes your claim.

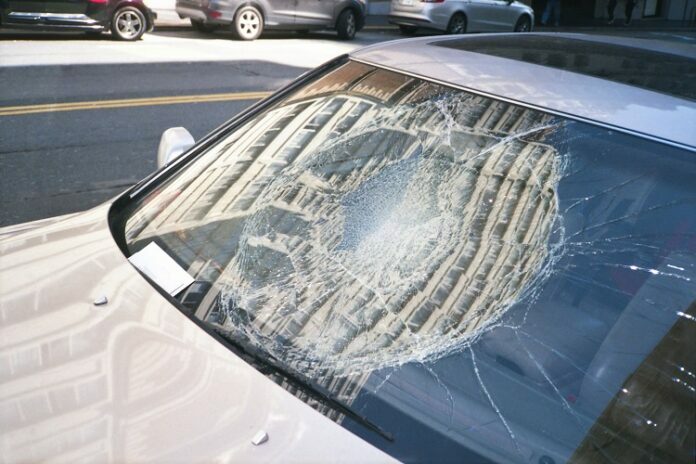

The most challenging aspect of handling claims is inspection when it comes to car insurance claim rules. When you’re in an accident, the first thing you must do is call your insurance company. Your claim is recorded by the insurer, but you must wait for an authorised personnel to check the damage to your car and submit it to the insurance company. This can take several days, and you can’t afford to wait that long if you drive your car to and from work every day.

Table of Contents

How can you inspect your own car?

- First and foremost, you should contact your auto insurance company as soon as possible when an accident occurs.

- When you call your insurance company, the employee will instruct you to use the app.

- You must log in to the app and enter the essential policy and car information.

You must use your camera to take a photo/video of the damage to your vehicle and upload it to the application.

- Your request is processed in real time when you send the photo or video.

- Your request is granted if all of your information is correct and your self-check is correct.

Advantages of Using an App

1. Vehicle examination on-site

In general, if you file an insurance claim, you should allow at least a day or two for approved insurance company representatives to inspect your vehicle. This indicates that your request will not be reviewed or approved for at least two days. By the way, you should never drive a damaged car on the road. This means that both your regular commute and your commute are now jeopardised. An application, on the other hand, allows you to get your car assessed quickly following an accident. You won’t have to wait for a review before the claim may be processed further.

2. Transparency

Normally, it takes a few days after submitting a claim application to be told of the situation. Even so, the criteria and circumstances for filing a claim are not always explained thoroughly. In the case of an app, however, the customer support person gives you every detail about how the request was processed and what to expect along the entire operation.

3. Waiting list has been shortened

Sometimes the difficulty of filing a claim begins before you even have a chance. When someone contacts an insurer after an accident, they usually have to wait for the insurer to contact them again. This means that in the event of an accident, you must assess the damage, return to safety, and much more. You need not have to wait for a response from your insurance company if you use an app. You contact the insurer via the app and receive a fast response because the review must be completed as soon as feasible.

4. Renewing the insurance policy is easy

When it comes to the time of renewing your insurance policy every year, using such a method helps make a good decision when considering how to renew car insurance. Policies can be renewed with a few simple clicks.

The decision to get general insurance is made considerably easier with applications. As a result, you should use the insurance app to purchase 2-wheeler insurance.

Subscribe to Bajaj Allianz General Insurance Company YouTube Channel.

The topic of the solicitation is insurance. Please carefully read the sales brochure/policy wording before closing a deal for more information on advantages, restrictions, limitations, terms, and conditions.

Source: https://indilens.com/600571-iltakecare-how-to-avoid-the-hassle-of-inspection/